CA Audit Procedures

Almost all type of organizations record each and every financial transaction that

occurs during the course of business and on the basis of these records, they prepare

their financial statements.

When the financial statements of an organization are examined and reviewed to make

sure that all the records are fair and free from any error and misrepresentation,

it is called financial audit. There are two common types of audits in an organization,

one is called an internal audit and other is called external or statutory audit.

Internal audit is conducted by an organization’s own employees in a view to improve and

implement internal controls and the effectiveness of risk management. In most cases,

there is no obligation on the qualification of an internal auditor.

External or statutory audit is mainly concerned with the audit of the organization’s

financial statements for a specific period which mostly consist of one financial year.

Statutory audit is carried out by a chartered accountant who has the required practical

experience and skills. The external audit is carried according to the rules and procedures

defined by the International Auditing and Assurance Board (IAASB). In this article, we

will discuss the audit procedures used by a chartered accountant to conduct an audit of an

organization’s financial record.

Overview of Audit Procedures

Once the audit objective, scope, and approach are defined, the next step is to plan the

techniques and process which will be used by the auditor to obtain conclusive audit

evidence to support his final opinion at the end of the audit process. The term audit

program and audit procedures are sometimes used in the same sense. In most of the audit

firms, audit procedures are defined by an experienced partner or approved by a senior

member of the firm to assure that all the potential risks are addressed in the procedures.

Audit procedures may vary from organization to organization depending on the size and

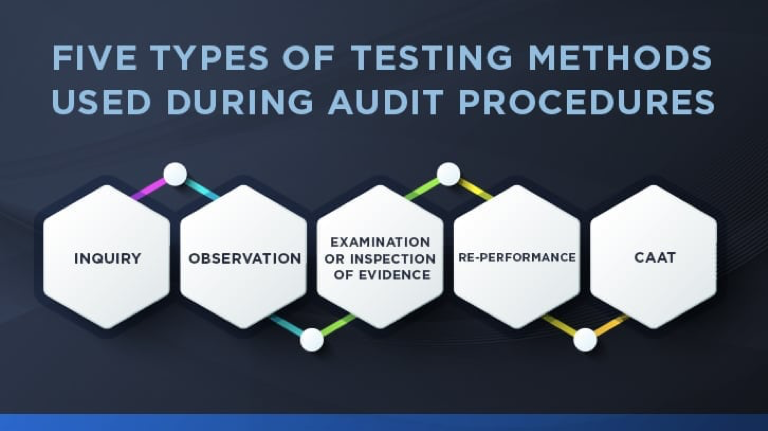

internal controls implemented. The common audit procedures used by auditors requires

strong analytical and observation skills. Following is the list of common audit

procedures:

- Analytical Procedures

- Inspection

- Observation

- Recalculation

- Inquiry

Let’s discuss them one by one below.

1. Analytical Reviews

Analytical procedures are carried out by the auditor through the whole audit process.

This procedure is an analytical examination of an unusual transaction by the auditor

and upon these analytical findings, the auditor decides whether to perform any other

procedure or not.

The main purpose of conducting analytical procedures is:

- To identify high-risk areas in the business

- To understand the business and get knowledge about the industry

- To assess the consistency in the financial record

2. Inspection

Inspection is the procedure through which the auditor performs an examination of

financial documents and verifies the whole process which results in the production

of that document.

Inspection of financial documents is the main part of the audit program. For example,

the auditor wants to inspect a payment voucher which is produced against a payment

issued to a vendor. So, the auditor will inspect all the supporting documents like

vendor’s invoice, Goods received note, etc. and will confirm that the goods are

actually received by the company and whether or not all the company’s SOPs are

followed in the process.

3. Observation

Gathering data and understanding of the business process to obtain audit evidence by

using strong observation skills by the auditor is called observation procedures. In

these procedures, the auditor assures the correctness of procedures carried by the

company employees. Sometimes the auditor may collect his own record to cross-check the

figures at the end of the process.

For example, the auditor can join the stock taking team and observe the process of

stocktaking and verify whether all the SOPs of the company are carefully followed

by the company’s employees or not.

4. Recalculation / Performance

It is a type of audit procedure performed by the auditor to verify the figures

calculated by the company employees.

For example, the auditor can calculate the total salaries and wages of the company and

cross check with figures provided in the company’s financial statements.

5. Inquiry

If there is something that needs to be explained further, the auditor uses inquiry

procedures to get information about the matter from the company’s employees and the

management.

The inquiry process is going through the entire audit process. It is performed in the

planning stage where the auditor gets information about the company’s business operations

and recordings of the processes for transactions.